Pas encore d'identifiant ?

What’s the Home loan Disbursement Process for less than Construction Possessions?

To acquire significantly less than-framework properties in the Asia offers a variety of you are able to expense positives and you can modification choice when compared to to shop for ready-to-move-in the home. However, that it requires an abundance of danger, including waits into the framework together with deviations out-of in the past established possess. Understanding the financial disbursement processes for under framework house is crucial for homebuyers. Instead of fund getting completed functions, disbursements at under-framework homes were created from inside the stages, centered on design improvements, and really paid on the designer. That it phased percentage means shelter the buyer’s money and you will means brand new bank’s visibility is actually lined up toward project’s end level. Customers have to be always the development-linked commission plan, maintain normal telecommunications on the financial to make sure timely disbursements, and you will display the newest project’s advances to end attention towards undrawn number. Experience in this step can rather impact the economic think and you may total exposure to to invest in an around-framework assets when you look at the Asia. This web site of the L&T Realty requires a close look at that processes, providing a better concept of how to begin to shop for a less than-design family.

Skills Mortgage Disbursement

The home mortgage disbursement process requires the release of mortgage quantity because of the lender on borrower, generally inside levels, based on the design improvements of the property getting purchased. This step includes the newest submission of one’s application for the loan, verification of the property, the borrowed funds approve procedure in banks, lastly, the fresh disbursement alone. An important entities that are primarily doing work in this step was brand new borrower, the lender (always a financial), and property creator. As previously mentioned earlier, the newest disbursement may either become full or partial, with respect to the loan agreement additionally the build phase of your own assets.

Financing Processes and you may Construction Mortgage Disbursement Grade

Once we has actually talked about at the start of the web log, financial disbursement for less than-build qualities is normally put out when you look at the stages, predicated on build progress, directly to the newest creator, making certain finance are used for invention. Conversely, loans to possess able functions is paid in one single lump sum payment to the merchant abreast of mortgage recognition and you may completion out of courtroom formalities, highlighting the immediate transfer out of control. You’re questioning what’s mortgage disbursement process at under-construction belongings.

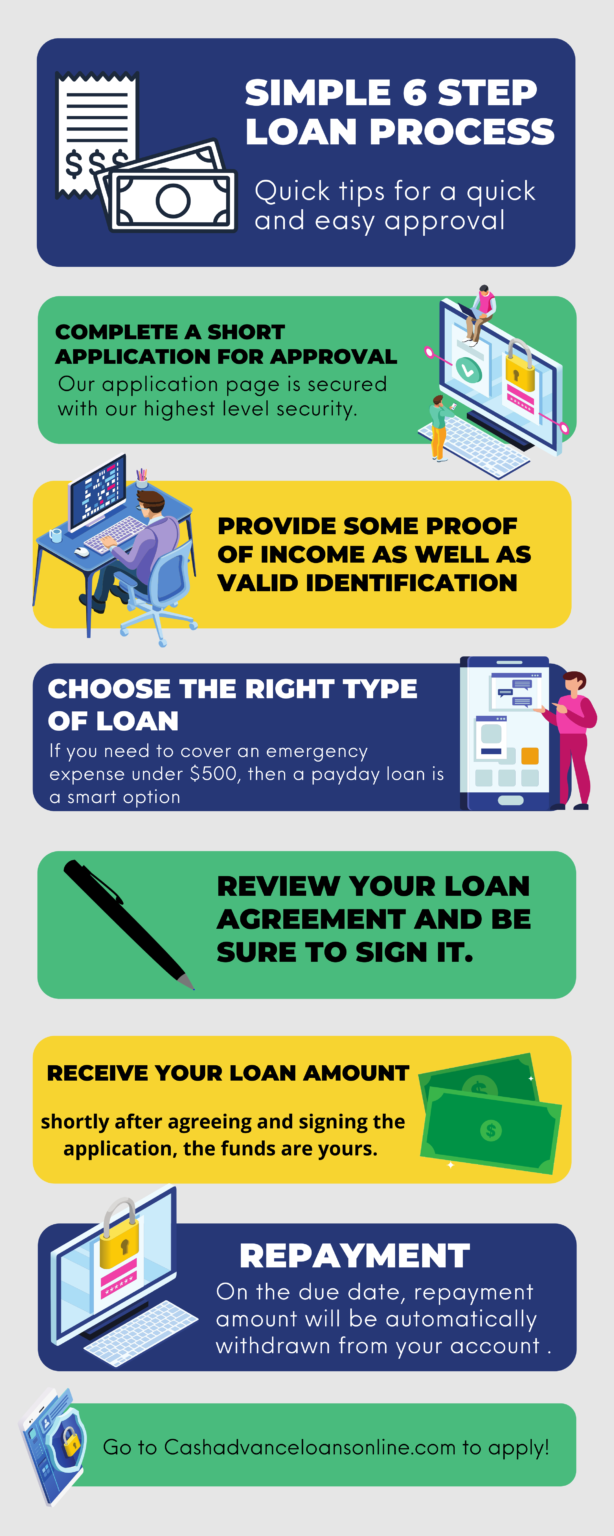

- Software Submission: Fill out the loan software and additionally requisite records, including label research, target facts, earnings files, and you will details of the house.

- Court and Technology Verification: The lender conducts a legal see regarding possessions data files and you will a tech research of your design enterprise.

- Mortgage Agreement: Just after approved, signal the borrowed funds agreement, detailing the mortgage words, disbursement agenda, and interest rates. The agreement performs a vital role since it lawfully binds both activities into the decided terms and conditions.

- Disbursement Request: Complete an excellent disbursement consult form in addition to the demand page away from new creator, which determine the present day phase from structure and the count expected.

- Disbursement: The financial institution disburses the borrowed funds amount within the installment payments in line with the framework values, straight to the builder’s account, guaranteeing the loan matter is utilized to have design aim.

Mortgage Disbursement Grade

Through to mortgage recognition, the financial institution items a beneficial sanction letter explaining the loan amount, period, rate of interest, and validity. The fresh new debtor need to after that fill out a down payment bill or any other files such as the allocation letter and you can encumbrance certificate for additional handling. The bank evaluates the house in advance of disbursing the mortgage, in a choice of complete or in installments, based on the progress of one’s project’s structure plus the financing rating of the debtor. Observe that the final interest rate can vary from the first offer, installment loans online in North Carolina on the financial issuing a changed approve letter properly.