Pas encore d'identifiant ?

Things to Learn Ahead of Using a house Guarantee Line of credit or Financing

Collateral ‘s the difference between everything individual and you may everything you owe on the residence’s worthy of. A couple of common ways to borrow money out of your home security is property security financing and you can home security credit line (HELOC). Having Canadian rates of interest nonetheless reasonable and you will property opinions stable or increasing, credit money from new guarantee of your house are a keen glamorous money selection for debt consolidation reduction, reily.

Household security fund and you will HELOCs was favoured of the loan providers since the if you’re unable to repay everything you lent, he has your house given that shelter. People specifically for example credit lines because they can mark funds from her or him anytime during the a reduced interest rate than credit cards. Lowest money into the good HELOC also are lowest so when people pays down whatever they are obligated to pay, financing getting offered once more to them up to a-flat restriction. The latest favourable line of credit interest rates, combined with revolving use of borrowing from the bank plus the versatility to attract considerable amounts at tend to, are making HELOCs a famous treatment for acquire.

Is actually an excellent HELOC otherwise Household Collateral Mortgage Right for Myself?

A line loans Moody AL of credit or one-time equity loan can be used for everything from home renovations so you’re able to big ticket sales. Exactly how much you spend and you may what you invest it with the is actually totally up to you. As a result, with property equity line of credit would be a great financial device if you find yourself disciplined and you may diligently follow a fees package. But not, for a number of anybody, with a credit line will likely be a means of getting and you may becoming indebted.

Before taking away a home equity line of credit (HELOC) or loan, here are some what to remember to determine if it’s best for you:

Financial, Home Guarantee Mortgage, and you can Domestic Collateral Line of credit What is the Difference?

HELOCs, household equity funds, and you may mortgage loans the make use of your house because the protection with the financial obligation. All the step 3 could also be used in order to consolidate obligations. But that’s the spot where the parallels avoid.

What is a home loan?

A home loan are financing particularly to shop for real estate. The loan uses the actual home once the equity towards the mortgage, which means in case the debtor doesn’t pay back the loan, the lending company contains the right to seize the house. Like any mortgage, attention is actually energized on top of the prominent, and every mortgage payment generally combines paying the primary which is focus.

What is actually a property Guarantee Loan?

A home collateral mortgage, also known as an extra mortgage, allows people so you can borrow funds resistant to the collateral in their house. The mortgage appear given that a one-date lump sum payment and exactly how make use of its around your. Like, it does pay money for house home improvements, medical expenses, otherwise expenses. For example a home loan, your home is equity into financing, and it will feel paid more than a set period of time. The rate would be repaired or varying based on how the bank structures the borrowed funds and you may everything you agree to.

What is a house Security Credit line or Household Equity Line of Borrowing (HELOC)?

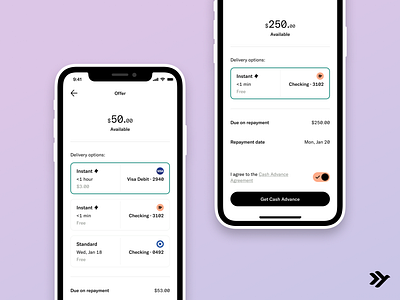

Such a home collateral financing, a house security line of credit (HELOC) is a loan that makes use of the brand new security of your house since the guarantee. Yet not, it financing requires the type of a good rotating personal line of credit in the place of a lump sum payment. This kind of line of credit now offers better independence because you have use of a swimming pool regarding fund, and once more, the manner in which you utilize it can be your. It may help you to own problems, debt consolidation, property update project, if not go out-to-date investing.

Payments to your your credit line is flexible as well. Based the loan contract, you might spend as low as just the appeal to your a HELOC, and thus you don’t need a deadline on the repaying exactly what you really borrowed. Credit lines also come with varying interest levels which might be dramatically reduced compared to interest rates toward handmade cards.

Lines of credit are just like credit cards in this you have to pay attract making money about what make use of. Including, while recognized to own an excellent $25,000 HELOC but only obtain $5,100000, then you’ll definitely just need to spend interest on that $5,one hundred thousand.