Pas encore d'identifiant ?

How to Assess Amortization having an additional Percentage

The following month, the loan harmony will be $ quicker, so you are able to repeat new calculation having a primary amount of $149,. This time, their desire payment might be $, as well as your principal payment could well be $.

Only do that another type of 358 moments, and you’ll has actually on your own an amortization table for a 30-12 months financing. So now you know why playing with an effective calculator is really easier. But it’s nice to understand the mathematics behind the fresh calculator really works.

You may make a keen amortization schedule having an adjustable-speed financial (ARM), it relates to guesswork. For those who have an effective 5/step 1 Sleeve, the brand new amortization plan into basic 5 years is straightforward to help you estimate because price is fixed into earliest five years. After that, the rate commonly to switch immediately after per year. Your loan terminology say how much cash their price increases per year additionally the highest that your rate can go, plus the low price.

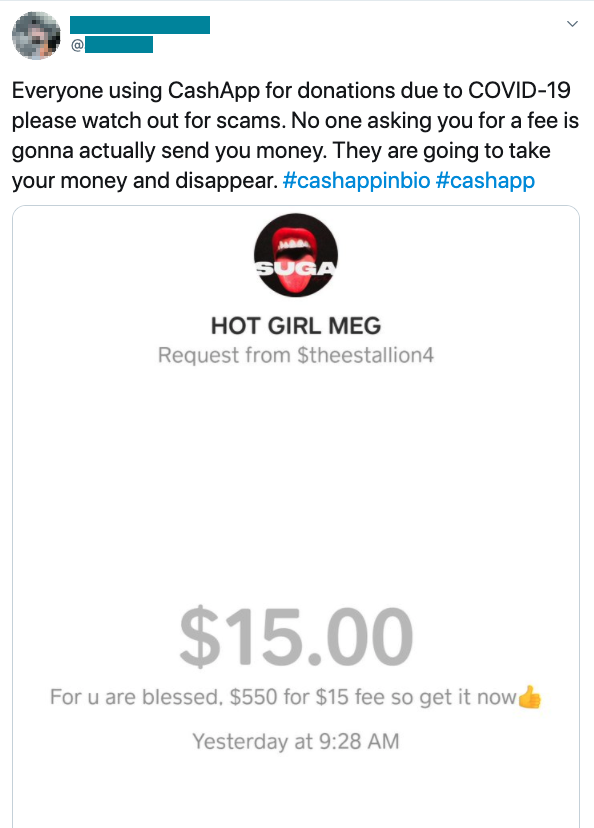

Often some body should lower their money quicker to save cash on attention and might plan to generate a supplementary payment or increase the amount of on their regular payment per month to get lay towards the payday loan Brighton the principal when they can afford they.

Instance, for many who planned to include $50 every single payment, make use of the latest formula above to help you assess a different sort of amortization agenda and watch simply how much ultimately you’ll pay back their loan as well as how much less interest might owe.

Contained in this example, putting a supplementary $fifty monthly towards the their mortgage create help the payment per month to $. Your own interest fee in times one could nevertheless be $, but your prominent fee was $. The few days a couple of financing balance do following become $149,, plus 2nd month’s appeal commission is $. You’ll curently have spared fourteen dollars in the desire! Zero, that’s not very exciting-but what was fascinating is when you leftover it up up until your loan try reduced, your complete attract perform amount to $80, as opposed to $ninety five,. You’d additionally be obligations-100 % free almost 3? decades sooner or later.

Home loan Amortization Isn’t the Simply Kind

There is spoke much about home loan amortization up until now, once the that’s what some one constantly think of after they tune in to this new keyword amortization. But home financing is not the only variety of financing you to can amortize. Automobile financing, home guarantee loans, college loans, and personal finance and additionally amortize. They have fixed monthly premiums and you may a predetermined incentives big date.

And this form of fund do not amortize? When you can reborrow currency when you pay it back and you can don’t need to shell out your debts completely from the a specific date, then you’ve a low-amortizing financing. Credit cards and you may personal lines of credit is examples of low-amortizing funds.

How do Using an enthusiastic Amortization Calculator Help me to?

- See how much dominant might are obligated to pay any kind of time upcoming date during your mortgage title.

- Observe far attract you reduced in your mortgage up until now.

- Observe much attract you’ll be able to shell out if you secure the loan through to the stop of the name.

- Work out how far security you will have, while you are 2nd-speculating the monthly loan declaration.

- See how far notice possible spend along the whole name away from financing, in addition to the impact out-of opting for a longer or quicker financing term otherwise bringing a high or lower rate of interest.

What does Totally Amortizing Imply?

A fully amortizing mortgage is just one where in actuality the regular fee matter stays fixed (if it’s repaired-interest), however with varying quantities of one another focus and prominent becoming paid out of when. Thus the attract and you can prominent to the loan could be totally paid back when it matures. Conventional fixed-speed mortgages is types of totally amortizing fund.