Pas encore d'identifiant ?

Stablecoin Leadership Continues Through A Goldman-coinbase Exchange

This uncertainty could make both consumers and sellers hesitant to transact in crypto. Stablecoins are a sort of Bitcoin alternative (altcoin) that’s constructed to offer more stability than other cryptos. Some are actually backed by a reserve of the asset they symbolize; others use algorithms or different strategies what is a stablecoin to maintain their values from fluctuating too much. As a outcome, stablecoins allow customers to have the identical retailer of worth opportunity as US Dollar holders, no matter the place they’re from.

What Are The Risks Of Stablecoins?

BTC and other cryptocurrencies are at present not able to offer the same stage of stability and scalability for real-time transactions as in comparability with stablecoins. If a stablecoin loses its intended value and is unable to rapidly recuperate it, it turns into functionally useless. Remember, a stablecoin’s major purpose is to supply value stability where different cryptocurrencies may not have the ability to. If it can’t ship on this, there is no cause for anyone to use it. Some kinds of stablecoins can also be used for crypto staking, in which cryptocurrency owners can earn rewards by essentially lending out their holdings to assist execute different transactions.

Stablecoins: Definition And The Way They Work

At the time of writing, a total of fifty five.8 billion USD Coins are in global circulation. The advantage of this is that it allows extra effectivity, and allows central banks to make use of a single ledger to account for cash supply. This also reduces central financial institution reliance on industrial banks to manage the issuance of new cash into the economic system. Although it requires one to trust the underlying good contracts, this kind of stablecoin system is designed to run with out touching the standard monetary system..

You’re Our First PriorityEach Time

Value derives from the expectation that the system will be succesful of maintain the stablecoin steady. To mint 100 DAI pegged to USD, you will need to provide $150 of crypto as 1.5x collateral. If you want your collateral back, you’ll must pay back the one hundred DAI. However, if your collateral drops under a sure collateral ratio or the loan’s value, it will be liquidated.

There Are Four Types Of Stablecoins:

- However, if your collateral drops below a certain collateral ratio or the loan’s worth, it goes to be liquidated.

- These specific Stablecoins allow holders to participate within the gold market and have the utility benefits of a cryptocurrency with out the challenges of bodily owning gold bars.

- Although to not the identical extent as TerraUSD, investors nervous in regards to the reliability of reserves, and whether or not Tether was totally collateralized.

- There has long been controversy concerning the reliability of the collateralizing reserves concerning sure stablecoins (i.e., that the stablecoin’s liabilities are greater than its reserves).

This means it’s typically tricky for buyers to swiftly money out their cryptocurrencies when the going will get powerful. To accomplish that they could should transfer across a quantity of exchanges, or even wait several days. Crypto’s whole market capitalization can rise and fall by billions of dollars a day. Even the highest cryptocurrency—Bitcoin (BTC)—is topic to significant fluctuations in value. Over the previous month, traders have seen around a 4% day by day change in the value of BTC.

And while the concept of algorithmic stablecoins has advantage, there is still a lot to determine right here, so proceed with warning. A stablecoin is a cryptocurrency that’s designed to make transacting with crypto extra practical. Currently, cryptocurrencies are unstable and can expertise dramatic worth fluctuations in a short time frame. Bitcoin, for example, can rise or drop by double-digit percentages in just some hours. The worth of most cryptocurrencies is basically decided by what the market will bear, and many individuals who purchase them are doing so in hopes that they may improve in value.

Seigniorage-style/algorithmic Stablecoins (not Backed)

They also can facilitate high-speed transactions internationally at a low cost. Some nations are even experimenting with creating their very own stablecoins. As a stablecoin is a kind of cryptocurrency, it’ll doubtless fall under the identical rules as crypto in your native jurisdiction. Issuing stablecoins with fiat reserves may want regulatory approval. The stablecoin issuer ensures stability of their cryptocurrency by keeping fiat forex as collateral with a financial establishment. The stablecoin always has a set quantity of fiat foreign money in reserve that’s proportionate to the stablecoins it has issued.

When it’s time to withdraw the original collateral quantity, the user must put the initial quantity of DAI, plus curiosity, again into the good contract. A stablecoin is a kind of cryptocurrency whose value ought to tie to a different comparatively “stable” asset like the us dollar, euro, or gold. All of that is potential today, and an entirely new industry based on cryptocurrencies – DeFi, or Decentralised Finance – is quickly gaining momentum partly enabled by stablecoins.

Dai, a cryptocurrency-backed stablecoin, makes use of ether (the cryptocurrency on Ethereum’s platform) as backing, whereas its value ties to the US greenback. Unlike different stablecoins, DAI is decentralized and makes use of sensible contracts and incentives because the mechanism to keep up its peg. Many conventional fiat currencies are vulnerable to inflation, particularly in economies with high interest rates.

It’s important to note that algorithmic stablecoins haven’t any reserves at all. Instead, these algorithms hyperlink two cash (a stablecoin and a cryptocurrency that backs it) and adjust their value relying on the tenets of supply and demand. If the market value of the stablecoin falls under the value of the fiat currency it tracks, token supply is lowered.

Their primary distinction is the strategy of keeping the stablecoin’s value steady by controlling its supply through an algorithm, primarily a computer program running a preset formulation. All this volatility may be great for traders, nevertheless it turns routine transactions like purchases into risky speculation for the buyer and seller. Investors holding cryptocurrencies for long-term appreciation do not want to become well-known for paying 10,000 Bitcoins for 2 pizzas. Meanwhile, most retailers do not need to end up taking a loss if the worth of a cryptocurrency plunges after they receives a commission in it. The initial launch of PYUSD might have flown underneath the collection radar of the crypto market in August 2023, which was followed rapidly by an SEC enforcement action in November 2023.

According to @chainalysis information, Nigeria ranks #2 globally in crypto adoption, additional underscoring the impact of apps like MiniPay in accelerating stablecoin utilization in rising markets. HMT published an open session (PDF 271KB) in May, proposing that a modified Financial Market Infrastructure Special Administration Regime (FMI SAR) be utilized. Past efficiency isn’t a assure or predictor of future performance. The worth of crypto assets can improve or lower, and you can lose all or a considerable amount of your buy value.

Additionally, @Tether_to has pre-minted an extra $200 million USDT on Celo, signaling robust anticipation for future demand. Instead, it reflects real exercise and rising demand for stablecoin usage on the platform. Every lending platform might have different procedures for danger administration, charges, and incentive schemes that could affect the rates of interest offered on stablecoin deposits. To discover the best fit for his or her requirements, buyers should totally examine the actual options and terms of every platform.

This is a highly experimental and still largely unproven concept, and its nature has led to legal backlash – with Basis, a now-defunct pioneer, has been shut down as a outcome of regulatory considerations. This is essentially the most intuitive and straightforward approach to achieve stability. It was the first model for use, and it’s by far and large essentially the most prevalent at present.

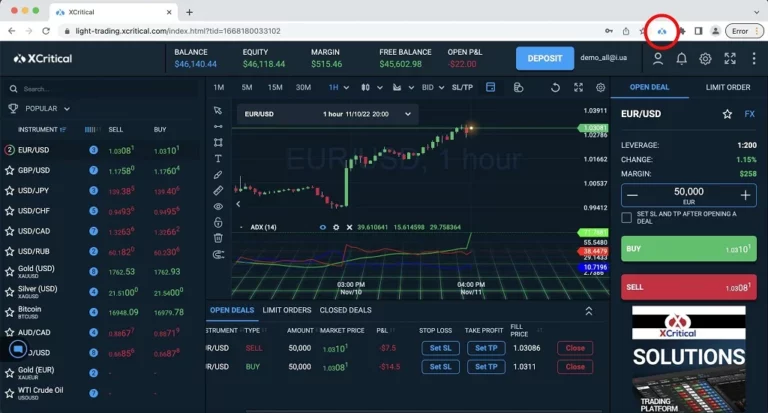

Read more about https://www.xcritical.in/ here.