Pas encore d'identifiant ?

What are the Different kinds of Framework Money?

The bank often ask questions towards builder you’re going to be working having. At all, the lending company will have to focus on your specialist, too. They are doing normal monitors of contractor’s performs and you may giving money after each phase of your endeavor their builder finishes.

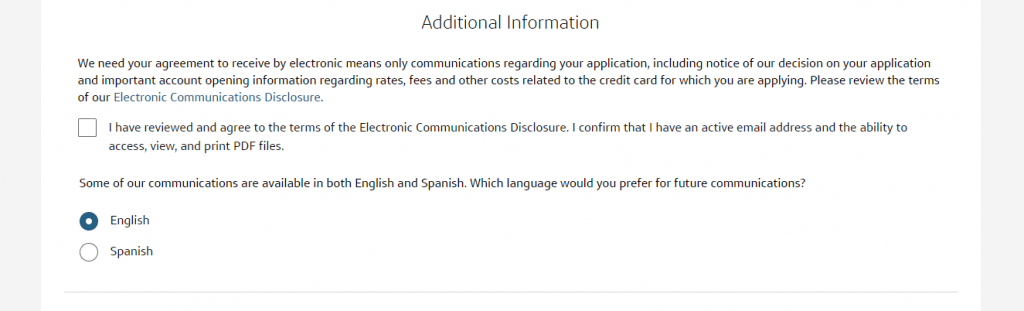

Your bank will look at your credit score along with your financial obligation-to-income ratio ahead of giving your on the loan. Very lenders commonly expect to look for a credit history out of within the very least 660 so you’re able to agree to a casing financing. They will certainly would also like observe a loans-to-income proportion from below 40% and an optimum loan-to-well worth proportion regarding 90%.

Certain lenders wanted a larger deposit than just they might loans Eagle to your a vintage financial. Usually, lenders often request a down payment of 20 so you can 31% of total cost of building endeavor. But not, that’s not usually the scenario. At the Job & Fundamental, i request the absolute minimum advance payment off simply 10% of the cost of the strengthening investment.

There are a few different kinds of construction loans on the market. Are all built to meet a new gang of means and you may a different sort of group of activities. Take time to find out how this type of fund works to ensure you could potentially figure out which choice is best for you.

Construction-Only Financing

Because identity implies, construction-merely finance buy the development of your own new home otherwise for the recovery of present house..

These types of fund constantly adult immediately following regarding the a-year otherwise smaller. Due to the fact label is finished plus house is founded, you will speak to the bank to start conversion process of your own framework mortgage so you can long lasting investment.

Renovation Loan

Finance getting merely building work your property also are labeled as restoration fund. Recovery fund are designed to help you do renovations in place of help you generate another household from the ground upwards. Different varieties of loans can work just like the recovery finance dependent on how costly your home update investment can be.

Whether your recovery is relatively reduced-cost – put differently, when you find yourself likely to be spending less than throughout the $20,000 – it could seem sensible to fund it which have a house security financing otherwise a property equity personal line of credit (HELOC). Refacing your own cabinets, strengthening another platform if you don’t repairing your homes roof every complement on the sounding domestic fix efforts that you could be in a position to pay money for having a home security loan or a good home guarantee personal line of credit. .

House equity type of loans often come with relatively lowest interest levels, leading them to an attractive choice. While fully renovating your bathroom, the kitchen, or your own basement, upcoming an effective HELOC could work for you as long as you got sufficient equity of your property.

Certain homeowners decide to fool around with an earnings-aside home mortgage refinance loan to pay for pricey solutions or home improvement tactics. You can use the surplus to pay for family home improvements – otherwise whatever else you would like. This will be a great way to get right to the domestic update projects that you’ve been searching forward to while also decreasing the monthly home loan repayments.

Owner-Creator Construction Loan

An owner-creator build loan are a specialist types of design financing made use of in the event that debtor is additionally the latest builder. When you’re an authorized, working contractor considering strengthening your home (otherwise starting comprehensive home improvements) yourself, this mortgage will make feel to you personally.

Summary

The entire process of design your perfect house is browsing search some other for everyone. For a lot of, it does imply purchasing house and you may developing a house from the crushed right up. For other individuals, this may suggest gutting an existing construction and you can rebuilding it to meet some requirements.