Pas encore d'identifiant ?

Done well, You may be Pre-Acknowledged! But, Precisely what does Which means that?

step 1. What does they imply to get pre-approved for a home loan?

« Are pre-accepted to have a mortgage means that you can use get our house you dream about, » said Brittany. « It indicates the lending company has examined the application also your own credit, possessions, and you will earnings, and has now determined you qualify for how much cash your is asking for, pending a reasonable assessment of the house you intend to purchase. »

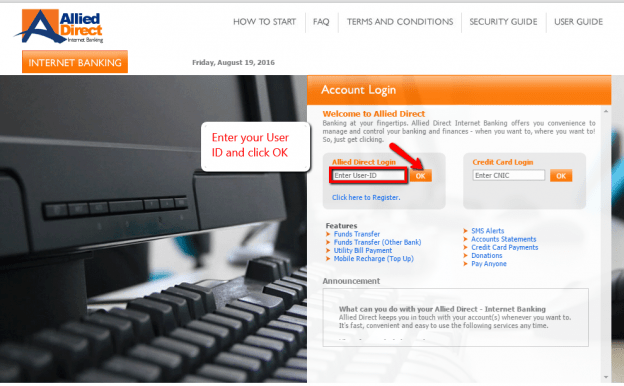

dos. How can i score pre-recognized?

« To track down pre-recognized, just be sure to start by filling out an application. You might finish the software yourself, to your our very own web site, or stop by on regional Northern Nation Coupons Financial and you may we will be prepared to help you, » said Brittany. « Once your software is complete, you will need to render confirmation records eg newest paystubs, last year’s W-2s, lender statements, and you may other things necessary to dictate debt eligibility. The application and documentation is then recorded, as well as the count youre requesting and you can a copy from your existing credit history and credit rating. After that, i hold off to see if you are acknowledged! »

It is vital to keep in mind that your revenue plays a big area with what youre recognized getting. Whenever deciding your home loan qualification, loan providers have a tendency to estimate the debt-to-income ratio. A loans-to-earnings ratio try a calculation of one’s monthly payments, like the asked loan amount including a house taxation and you can homeowner’s insurance coverage, split by the gross monthly money. The better your debt proportion, the fresh riskier it is on the lender so you’re able to provide your currency. For pre-approved, the loan count will need to be during the recommendations out of just what lender identifies you can fairly pay off below your latest economic issues.

step three. Do I would like pre-acceptance to locate a mortgage?

« Yes, providing pre-acknowledged is the foundation of securing a mortgage. The mortgages are believed pre-accepted until an appraisal of the property is completed and you can confirms that possessions match the newest bank’s requirements. »

The new appraisal process is an important step to be familiar with. An assessment occurs when an official and you may signed up appraiser, chosen by the lending institution, inspects and you will assesses the property you intend to purchase and provide the financial institution an estimated market value of the property personal installment loans in Surrey, according to research by the house’s health plus the previous selling price away from comparable home in exact same sector.

Clearly, much hinges on the newest assessment statement, and pre-approval will not make certain their mortgage consult is provided. Often, the new assessment makes or crack the deal. Such as, in the event your house is appraised in the a notably all the way down worth than just product sales rates your application is refuted. When you are which can be disappointing at that time, it might including help you save away from overpaying for your home.

4. Let’s say Now i need more I became pre-approved getting?

« If you would like acquire more cash into household out-of your hopes and dreams, we could complete a consult to improve the loan matter, and try to get you pre-accepted having a higher amount borrowed. »

5. Immediately following I’ve been pre-acknowledged, what’s the second step?

« When you are pre-approved, the loan Specialist goes more financing Estimate with you, » said Brittany. « That loan Imagine was an evaluation that presents exactly what your potential settlement costs could well be, including a payment per month and taxation and you will upcoming focus rate customizations. For people who indication one to means, thereby agreeing for the terms revealed to your guess, the financial institution have a tendency to assemble a small commission to cover the cost from a home assessment. »

Should your appraisal is accomplished additionally the house is located in order to feel regarding sufficient reputation and cost, you might progress having buying your fantasy household!

Loan Gurus Try Right here to aid

Buying a property can seem including a daunting task to start with, but it is definitely worth the effort when it mode unlocking the leading home for the brand new home. And you may, with the aid of Mortgage Benefits particularly Brittany on North Country Coupons Lender, the process are broken up into the steps that are simple understand and you may would. Don’t let financial vocab conditions particularly « pre-approval » stand ranging from both you and your future. Avoid in the regional Northern Country Savings Bank, pick up a credit card applicatoin, and you will meet with financing Pro now!